#FullRepeal Daily Digest

CQ: Court Decision Could Push Effort to Shut State Health Exchanges

- [likely this week] the U.S Circuit Court for the District of Columbia may rule on whether federal subsidies to buy insurance can only be given to the residents of states that have established their own health law insurance exchanges. Such a decision, if upheld by the U.S. Supreme Court, could shrink the number of states with their own exchanges, according to Michael Cannon, the Cato Institute analyst who has led the charge to strike down the current system that awards subsidies irresepective whether states create an exchange under the law…

- [Cannon said] that the number of states with exchanges could contract, not expand. Employers would lobby against having the exchanges because the mandate requiring employer coverage under the health law couldn’t be enforced in states without the marketplaces, he says.

- That’s because penalties against employers for not covering workers are only assessed if the workers can go to exchanges to get subsidies and buy policies. Opponents of the individual mandate also would rise up against states having their own exchanges, he adds, because penalties on individuals for not having insurance can only be assessed if affordable coverage is available and they refuse to buy it.

- And without access to subsidies, millions of people wouldn’t have access to affordable insurance benefits within the meaning of the health law and would be exempt from paying the increasingly stiff fines for not getting insurance, Cannon argues.

- [RELATED] The Los Angeles Times: Obama awaits another court ruling that could deal blow to health law

The Wall Street Journal: Some Still Lack Coverage Under Health Law Backlogs, Technical Glitches Stall Insurance Policies

- Months after the sign-up deadline, thousands of Americans who purchased health insurance through the Affordable Care Act still don't have coverage due to problems in enrollment systems.

- In states including California, Nevada and Massachusetts, which are running their own online insurance exchanges, some consumers picked a private health plan and paid their premiums only to learn recently that they aren't insured. Others received a policy but then got married, had a baby or another "life event" that required their coverage to be updated, yet have been waiting months for the change to take effect.

- Robert Rolain of Las Vegas, one of the plaintiffs, said that in October, he signed up his wife, Linda, using the state exchange for a Nevada Health Co-Op plan starting March 1. In November, a tumor was found on her brain, and doctors discussed surgery.

- Mr. Rolain paid $136 toward the first month's premium, which was offset by a tax credit of $420, according to a copy of his statement and a receipt. Mr. Rolain said he was dumbfounded when he took his wife to an oncologist in March and learned she wasn't covered. They postponed surgery for two months, he said, until they got notice that she was insured. "She wasn't so far along when they found the spot. Now the doctor said it had spread up the whole left side of her head," said Mr. Rolain, 73, whose wife had surgery May 14. By then, Ms. Rolain's survival prospects had diminished. She died June 30.

The New York Times: The Health Care Waiting Game Long Waits for Doctors' Appointments Have Become the Norm

- Merritt Hawkins, a physician staffing firm, found long waits last year when it polled five types of doctors’ offices about several types of nonemergency appointments including heart checkups, visits for knee pain and routine gynecologic exams. The waits varied greatly by market and specialty. For example, patients waited an average of 29 days nationally to see a dermatologist for a skin exam, 66 days to have a physical in Boston and 32 days for a heart evaluation by a cardiologist in Washington.

- The study found that 26 percent of 2,002 American adults surveyed said they waited six days or more for appointments, better only than Canada (33 percent) and Norway (28 percent), and much worse than in other countries with national health systems like the Netherlands (14 percent) or Britain (16 percent). When it came to appointments with specialists, patients in Britain and Switzerland reported shorter waits than those in the United States, but the United States did rank better than the other eight countries.

- And those waits are likely to get longer as the Affordable Care Act brings tens of millions of newly insured patients into a system that is often already poorly equipped to provide basic care. “I fully expect wait times to be going up this year for Medicaid and Medicare and private insurance because we are expanding access to care, but we’re not really expanding the system of providers,” said Steven D. Pizer, a health care economist at Northeastern University in Boston.

- [RELATED] Washington Free Beacon: Obamacare Overwhelming California Ers, Spiking Wait Times Average California ER wait time rises to 5 hours

Washington Post: Six months into Obamacare, some D.C. Insurance brokers still wait to be paid

- When the District launched its federally mandated health insurance exchange last fall, officials went to great lengths to woo professional insurance brokers — launching a special broker web portal, establishing a “concierge” hotline just for brokers and holding broker-only training classes.

- “I’ve been very supportive, I put a lot of work into it, and I’ve gotten nothing,” said Steve Nearman, a Virginia-based broker who says he has helped nearly 100 city residents find and buy insurance through the exchange and is owed thousands of dollars in commissions.

- Mila Kofman, D.C. Health Link’s executive director, acknowledged that broker commissions have been an issue for months but said the exchange is committed to fixing the situation soon.“It’s a really big problem,” she said. “People should be paid for what they do.”

The Fiscal Times: Medicaid Money Wasted in 2013: $14.4 Billion

- The federal and state governments are struggling to keep track of payments made through Medicaid’s managed care program—which resulted in at least $14.4 billion in improper payments last year. A new report by the Government Accountability Office said the government “did not closely examine the payments” going to managed care organizations (MOC’s), which include nursing homes, that work with state Medicaid agencies to provide services to beneficiaries.

- Currently about 50 million people receive benefits through managed care organizations instead of the traditional fee-for-service method where providers are paid for each service. MCO spending makes up about 27 percent of federal spending on the $430 billion-a-year program.

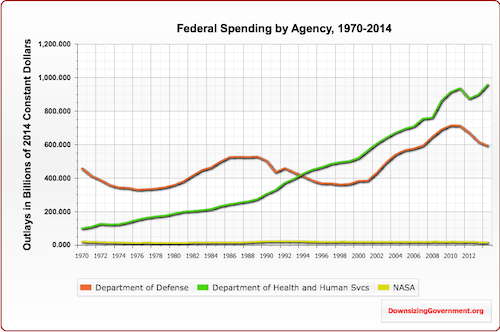

Federal Spending By Agency: HHS, DOD and NASA

from CATO Institute:

![]()